Always Fresh Mycouponstock News And Promotions With Our Beautiful Blog

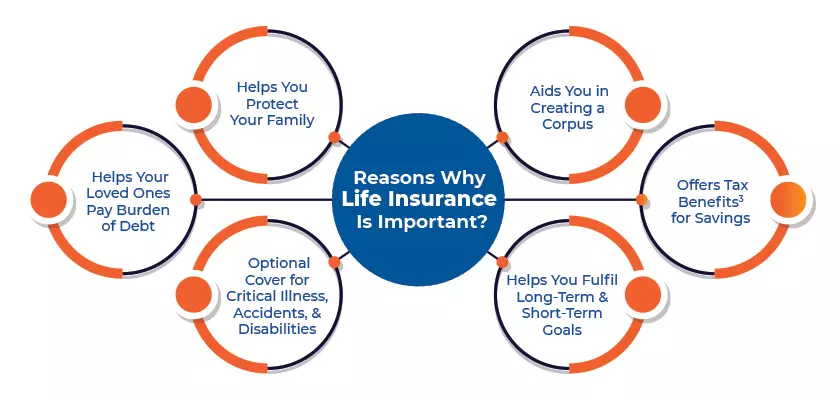

Everyone has different reasons for purchasing insurance. However, the main consideration in choosing insurance is making sure that you and the people you care about have access to financial security. Discover the necessity of life insurance and its importance.

Life insurance provides cash when you need it most. Your life insurance policy can deliver a specific amount of money when you need it. Upon your death, your family will receive your policy payout immediately. And that death benefit paid out by the insurance policy can help cover expenses such as, outstanding debts, mortgage payments, education expenses, and daily living expenses .

Money Replacement: If you are the family’s main provider of money, your sudden passing can leave your dependents without a way to support themselves. Your family’s financial needs, such as reaching short- and long-term financial goals, can be supported by life insurance, which can replace your salary and offer a consistent flow of funds.

Education Funding: Life insurance can be used to fund your children’s education expenses, ensuring that they have the necessary financial resources to pursue their academic goals, even if you’re no longer there to provide for them.

Peace of Mind: For you and your loved ones, having life insurance can bring about a sense of security. Knowing that your family will be financially secure and cared for during trying times gives you a sense of security.

Remember, working with a financial professional can help make this whole process easier. A financial professional can help explain the differences between types of policies, help you calculate the amount you need, and present potential options that may best suit your needs.

The benefits of life insurance

Leave Comment